Franchisors and franchisees need to understand franchise accounting basics. A mistake in transaction records could result in the franchisee or the franchisor being paid incorrectly. Once operating, the franchisee pays royalties each month, quarter, or year. Sometimes, the fee is a percentage of the net sales or a flat dollar amount.

This necessitates tracking key metrics to identify trends and potential problems. Maintaining consistent accounting practices and proper and timely reporting for all financial transactions is crucial for franchisor audits and verifications. Outsourcing bookkeeping for franchisees eliminates the need to hire full-time employees. Outsourcing eliminates the need to invest in additional hardware, software, or office space, too.

You became a franchisor to create a model to scale effectively and the opportunity to watch your brand reach new heights. In fact, this is one of the major advantages of buying a franchise — immediate access to an established brand versus having to start one from scratch. The franchisee pays the franchisor royalty fees monthly in exchange for using their branding. The franchisor uses the marketing fund for advertising materials that promote the entire franchise’s brand.

Conduct Regular Financial Analysis and Reporting

Everyone in the brand using the same system helps the franchisor maintain consistency, create reports and compare performance between franchises. Whether you’re running a mom-and-pop pizza shop or starting your own franchise, proper accounting and bookkeeping is an essential part of running a successful business. It’s important for franchise owners to have a solid understanding of these key terms and concepts, as they form the foundation of franchise accounting. Tracking expenses and revenue is a critical task in franchise bookkeeping.

It also prevents last-minute scrambling at tax time and shows an accurate picture of your franchise finances. With these factors in mind, you can choose the right bookkeeping franchise to start your business. Many bookkeeping franchises have low start-up costs, making them an attractive how do i find my employers ean option for potential franchisees on a budget.

Turn business receipts into data & deductibles

And standardization is most important when it comes to keeping financial records. However, many franchisors struggle with getting accurate tax software revenue numbers and financial information from their franchisees. Bookkeeping (the process of recording, storing, and retrieving financial transactions for an organization) is the core function of franchise accounting. Franchisors and franchisees both need to understand the intricacies of franchise bookkeeping for the model to succeed. A multi-unit franchise involves operating multiple franchise units within a specific territory. In this model, the franchisor generally provides more support and assistance with accounting procedures, but the franchisee still retains a significant degree of control.

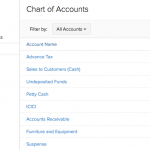

That’s why it’s imperative to define at the outset how the franchisee should establish their chart of accounts. That puts you and your franchisee on the same page — literally — from the very beginning. That, in turn, makes it easier to resolve disputes or misunderstandings or to avoid them in the first place.

Can I write off franchise fees?

- This is because bookkeeping services are essential for all businesses, and there is always a demand for these services.

- A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a particular time.

- This presents a significant opportunity for bookkeeping franchises to provide professional and quality services to businesses in need.

- Together, EmmerScale and Xendoo give you the time you need to grow your business.

But if you want to get a better handle on the process or want to give it a try yourself, here are some tips to get you started. You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Franchisers collect many business cards from vendors, industry colleagues, financial institutions, and potential customers. Detailed mileage reports can be generated to track and claim mileage deductions. This auto-categorization saves the franchise’s time and reduces errors.

Keep Accurate Sales Records

In the rare event of errors or discrepancies, we will promptly identify and rectify them, working diligently to maintain accurate financial records for your franchise. We provide virtual bookkeeping services to various franchise types and industries, including restaurants, retail, service-based franchises, and more. Remote Quality Bookkeeping can do more than just balance the books — we also offer payroll services for franchises. Hand your entire payroll process over to us and relax, knowing you’ll never have to stress again about your employees being paid accurately and on time.

We also get into some technology and outsourcing tips that you can apply to optimize your setup. We maintain open lines of communication how to calculate prepaid rent expenses via email, phone, and video conferencing. Regular updates, financial reports, and discussions ensure you are always informed and involved in the process. Our bookkeepers are highly qualified with relevant certifications and extensive experience in franchise bookkeeping. We use encrypted communication and secure cloud-based software to safeguard your financial information. You know that neglecting your financial records can hold back your franchise’s growth.